Value bets are bets on odds that are overstated by the bookmaker. Such an overestimation of the coefficient value can occur when the estimate of the probability of an outcome, according to analysts of the bookmaker, is lower than its true probability.

- Betting margin

- What are value bets?

- Search of value bets

- Self-estimate of the true probability

- Statistical method for estimation of the real probability

- Surebet as a source of value bets

- Example of setting up and searching in value bets in BreakingBet service

- Kelly criterion as a way to select the bet amount

- Pros and cons when playing on value bets

Betting margin

In order to understand in more detail, consider such a thing as a bookmaker's margin.

Imagine a situation where two players decided to bet on different outcomes - the loss of "eagle" or "tails". The probability of "heads" or "tails" is 50% and the players are in equal conditions.

Calculate the coefficient for the bet. The formula for calculating the probability coefficient:

K = 1/P, where P is the probability of the event outcome, in this case the "eagle".

Ideally, if a player placed a bet on this event, the odds would be 1/0.5 = 2. In this case, if we put 100 euro and win, we will get 200 euro, the loser will not get anything.

In the case of a bookmaker, the situation changes, the bookmaker's task is to understate the coefficients in order to be in more advantageous conditions in relation to You. The amount by which the coefficient will be understated is called the margin of the bookmaker.

The bookmaker will set the odds on the heads and tails, equal to, say, 1.9. In this case, the total probability of these two outcomes will not be equal to one, as it would be an ideal world, and 1/1.9 + 1/1.9 = 1.05. From here we calculate the margin: (1.05-1)*100 = 5%. This is the margin of the bookmaker in this case. Whatever the outcome, the player will receive 200 euro as before, but only 190.

Of course, in the case of single bets on luck, the difference can not be felt, but in the long term, due to the understated coefficient on the part of the bookmaker, you will remain in the red, as the theory of probability on the side of the bookmaker.

What are value bets?

There are situations when the bookmaker, incorrectly estimating the probability of the outcome, gives an inflated coefficient.

Let's say he estimated the probability of "eagle" in 2.2, and "tails" in 1.7. We know that he was wrong and the probability of falling that "tails" that "eagle" is the same and is 50%. So it is more profitable to bet on a higher coefficient equal to 2.2. Making 100 bets on 10 euro for "eagle", each time we win we get 10*2.2 = 20.2 euro. In theory 50 bets out of 100 we will win and we will get 50*(10*2.2) = 1100 euro, 1000 euro spent on the rates themselves. Our total profit will amount to 100 euro. In this case, bet with a coefficient of 2.2 is value bet.

In other words, overweight bets should have the following property:

K > 1/P, where P is the true probability of the event outcome and K is the bookmaker's coefficient for this outcome.

As we can see, in the case of the above rate on the "eagle" condition is met: 2.2 > 1/0.5, or 2.2 > 2.

Very often, the strategy of valuing bets is called value betting, and the bets themselves are overweight — value bets.

Search of value bets

From the definition of the value bets, we know that in order to find the value bets it is necessary to know the true probability of the outcome of the event, which is quite difficult. Below we describe a few ways to search.

Self-estimate of the true probability

Of course, if You are a great analyst, well versed in the sport, League or playing teams, or in the end a person with excellent intuition, then to assess the true probability of the outcome for You is not difficult.

For example, if the bookmaker gives a coefficient of 1.7 for the victory of Spartak over Dynamo, the probability of this outcome according to the bookmaker (taking into account the margin factor) will be 100/1.7 = 58.8%.

ut let's say You think the victory of Spartak is less likely and estimated it at 45%, the coefficient 1.7, the proposed bookmakers can be considered overvalued, those bet made on it will be considered a value bet. When estimating a probability of 45%, all odds above 100/45, or 2.22, will be considered overvalued.

Statistical method for estimation of the real probability

In fact, it is very problematic to correctly assess the probability itself, the better than it will make the analytical staff of the bookmaker. Of course there may be exceptions, but these are only exceptions. Therefore, another (but more real) way to estimate the true probability is the statistical method.

The true probability is easier to consider the average probability of the outcome, calculated on the basis of the probabilities of the outcome of each bookmaker. And the more bookmakers will be involved in the calculation — the more accurate the true probability.

For example, the victory of Spartak over Dynamo several Bookmakers give the following coefficients:

|

Bookmaker1 |

Bookmaker2 |

Bookmaker3 |

Bookmaker4 |

Bookmaker5 |

Bookmaker6 |

|

1.7 |

1.63 |

1.71 |

1.58 |

1.68 |

1.74 |

The average outcome will be 1.7+1.63+1.71+1.58+1.68+1.74/6 = 1.67.

The real probability is 100/1.67 = 59.8%.

Accordingly, the bookmakers, the coefficient for the victory of Spartak which will be greater than 1.67, can be considered overvalued, since their probability is higher than the true.

The more bookmakers involved in the evaluation of the real probability, the more accurate it turns out.

Surebet as a source of value bets

Another good source of finding value bets are the surebets. Of all the bets that make up the surebet, there is at least one value bet. Moreover, it is bet, most likely, was the initiator of the arb, because it is underestimated by the bookmaker outcome of the event and caused the formation of the surebet.

Example of setting up and searching in value bets in BreakingBet service

We have already considered the most common ways to search for value bets, but did not touch the easiest way — to search for value bets using finder services. In case of their use, You are already provided with information on the value bets found, it remains only to place bets.

Value bets finder BreakingBet allows you to ignore the manual search value bets, providing a search tool. The valuebets search is based on a statistical method. In accordance with user settings, the service finds for the probability for each odd and calculates the overvaluation.

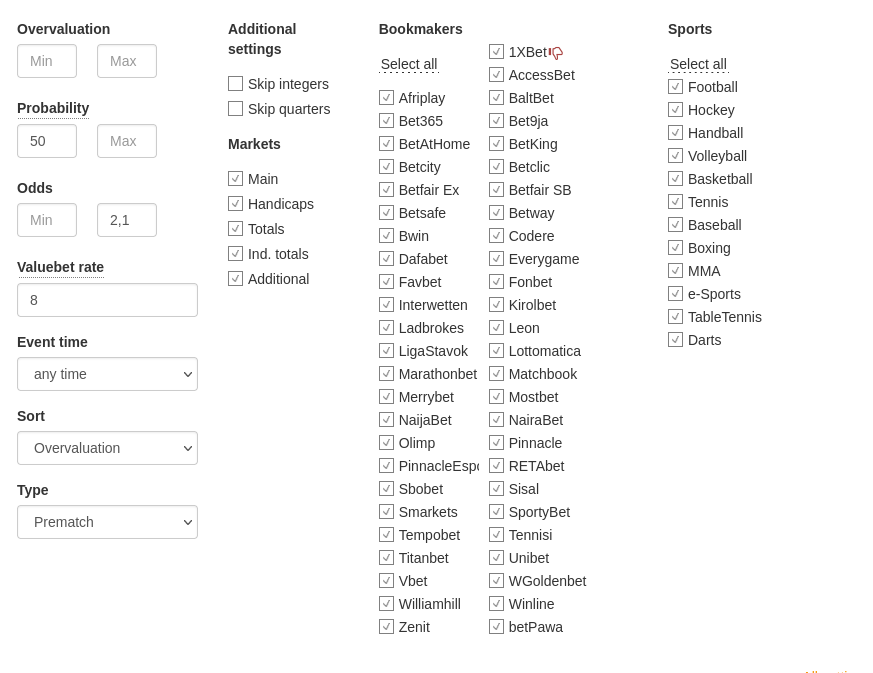

Now let's look at an example of setting up and searching for surebets using the service. Let's say we play at three bookmakers — Olimp, Fonbet, Bet365 and want to find value bets.

Go to the filter settings:

Basic search options:

Overvaluation — the main indicator showing the value of overvaluation for the current odd.

Propability — an indicator of the probability of an odd, calculated as the average of all the probabilities of this odd in scanned bookmakers. We recommend setting a minimum value of 50.

The valuebet rate is a parameter that specifies the minimum number of bookmakers that should form a surebet with an outcome, so that it can be assumed that this outcome is a bet with a preponderance. The greater this parameter, the more offices should form a arb with the outcome and the more accurate the assumption of its "value bet". The optimal value is 8-10.

Please pay attention! The odd can be highly overvaluated, but have a low probability, which makes such a bet very risky. We do not recommend using outcomes with a probability lower than

45-50%. The higher the probability, the more chances that the bet will win (in theory).

Odds — the numerical range of odds values. It is no secret that the probability of the outcome calculated by the bookmaker directly depends on its value. Therefore, in order to increase the chances of success, we do not recommend betting on odds greater than 2.2.

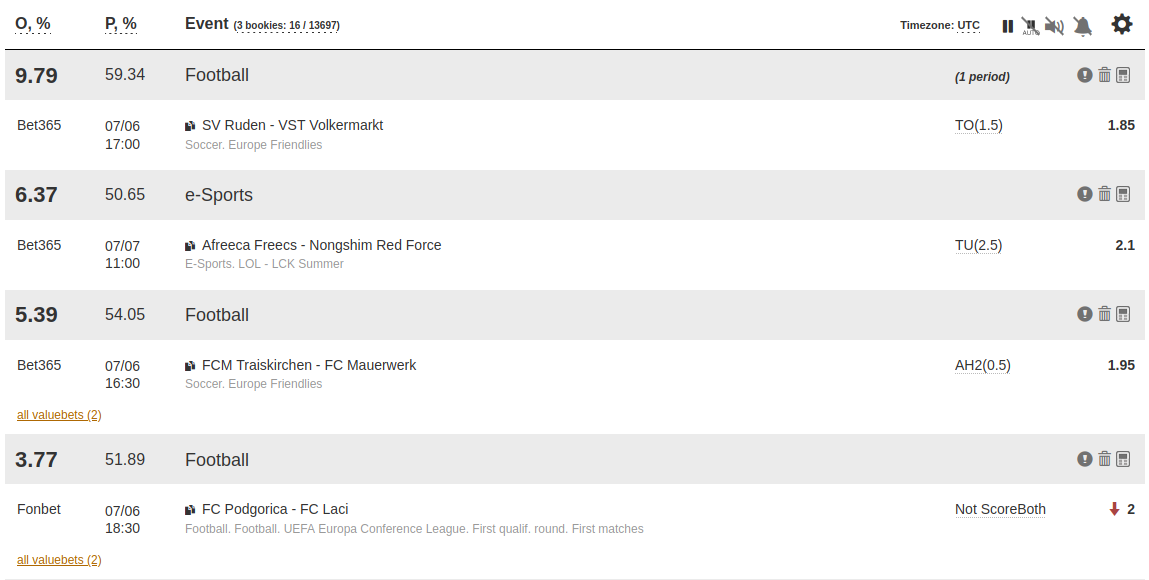

After settings we get a list of found value bets:

Do not forget to add your bets to History to be able to analyze the results of your work.

Kelly criterion as a way to select the bet amount

Often, when playing on value bets, the Kelly criterion is used to determine the value of the bet amount as a percentage of the total Bank. It is designed to optimize the growth rate of the General Bank and is used not only in sports betting.

The formula for calculating the amount of the bet:

((P/100)*K-1)/(K-1), where P is the true probability ( % ) and K is the bookmaker's coefficient.

Consider the example of the Mat Spartak-Dynamo. On the victory of Spartak in the match, the bookmaker gives a coefficient of 1.7. Your estimate of the true probability of winning Spartak is 65%. Applying the Kelly criterion formula, we obtain: (65/100 * 1.7-1)/(1.7-1) = 0.15. This means that according to Kelly's criterion we have to put 0.15 * 100 = 15% of the total Bank.

Do not forget an important rule: if Your estimate of the true probability is lower than the probability of the outcome of the event at the bookmaker, then it is not recommended to bet.

Unfortunately, the presence of such a parameter as the true probability in the formula significantly reduces the possibility of its use, because we need to know it. Nevertheless, it also happens that players minimize the risks of rapid loss of the Bank, putting not the percentage of the Bank, obtained after the calculations, and a percentage of this percentage. This greatly reduces the growth rate of the Bank, but also reduces the amount of lost funds in case bet loses. This approach is often referred to as a Fractional Kelly criterion.

Pros and cons when playing on value bets

Pros:

- Less bets (no need to bet on other outcomes)

- Not necessarily be registered in large numbers bookmaker

- Less suspicion on the part of bookmaker

- In theory, a greater profit than when playing Surebets

Cons:

-

A small number of bets will not guarantee a win. The greater the betting distance — the better. Moreover, it is recommended to bet on smaller amounts, but more often than on large ones, but less often.

Value Betting is a rather complex strategy compared to Arbitrage Betting, but it has a number of unique features that make it attractive to professional players.

- Automatic bet scanning

- Odds analysis at hundreds of bookmakers

- Time saving and high accuracy